Folks often lose track of their spending, especially when they're juggling multiple accounts or sticking to a budget gets tough. A checkbook register can be real handy here, helping keep tabs on cash flow in and out. Problem is, finding a good, user-friendly version you can print and use right away ain't always easy. It's about making finance management less of a headache.

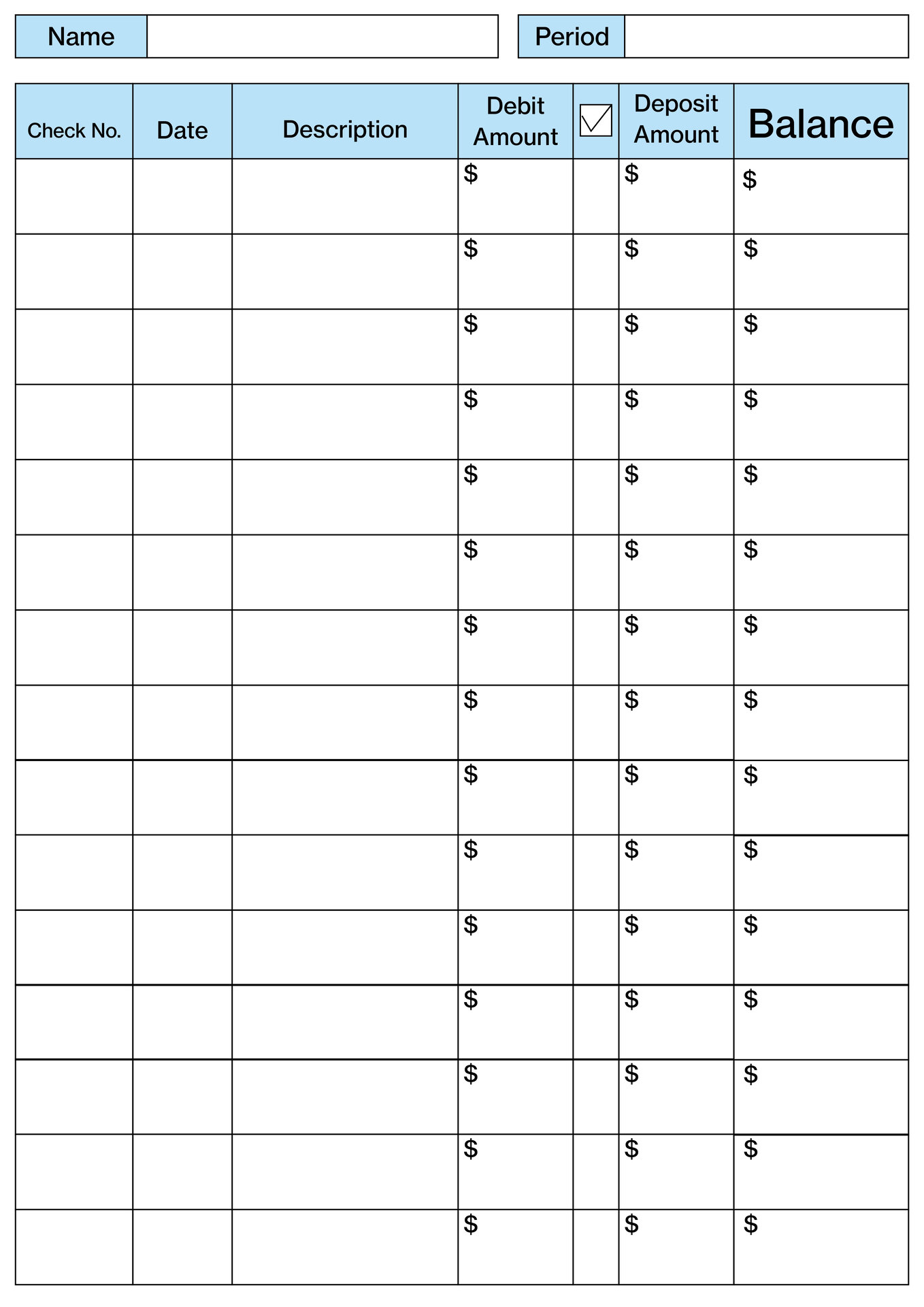

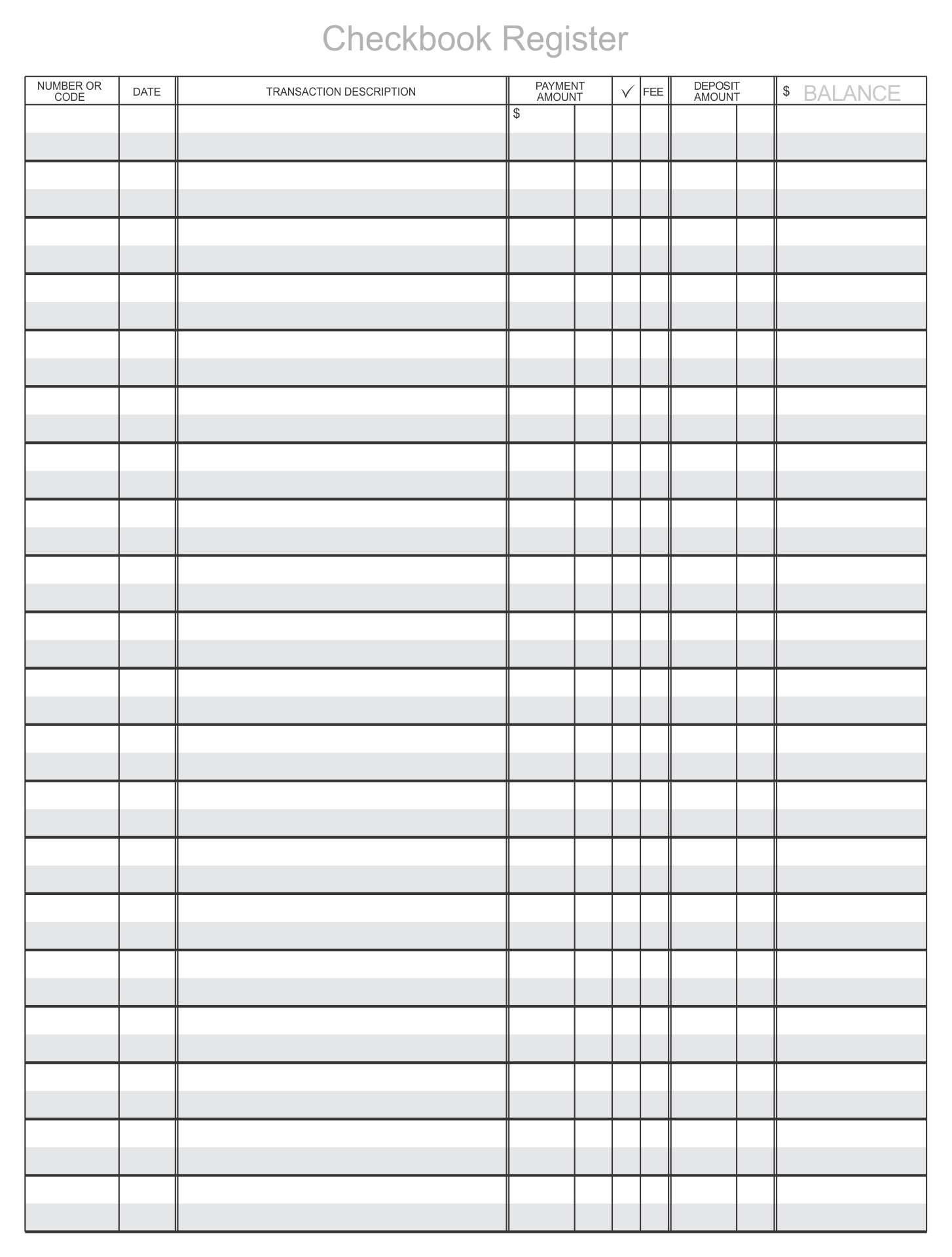

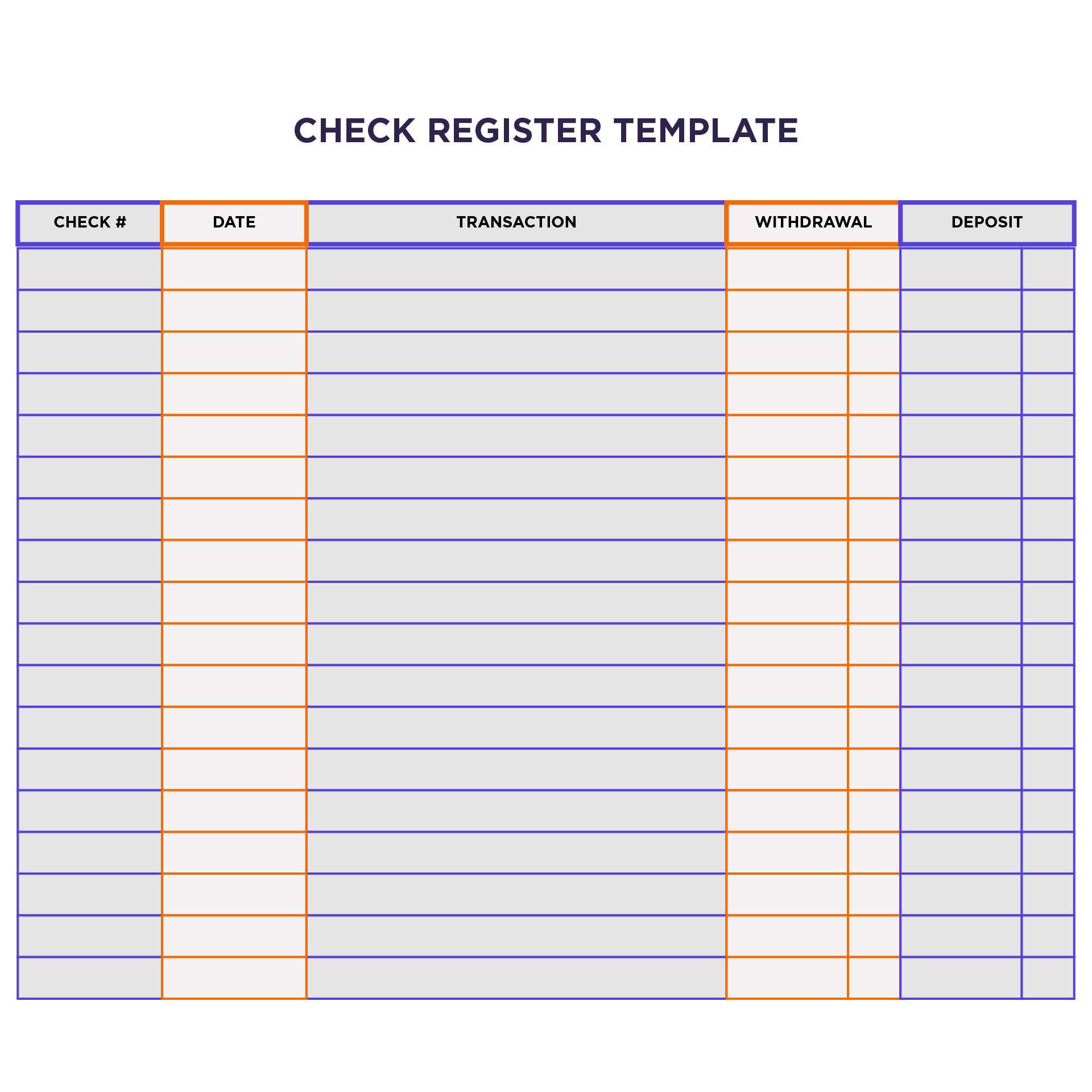

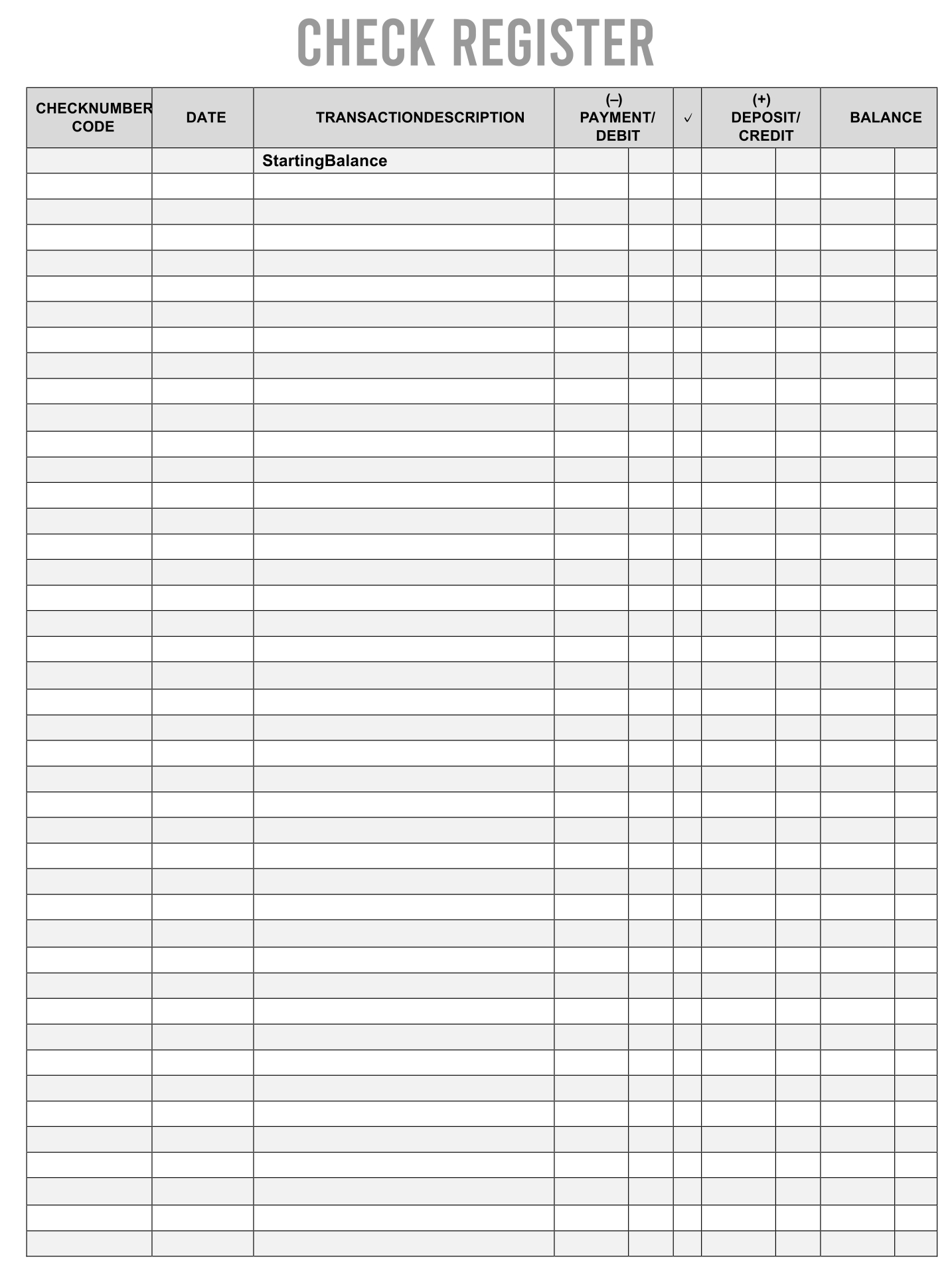

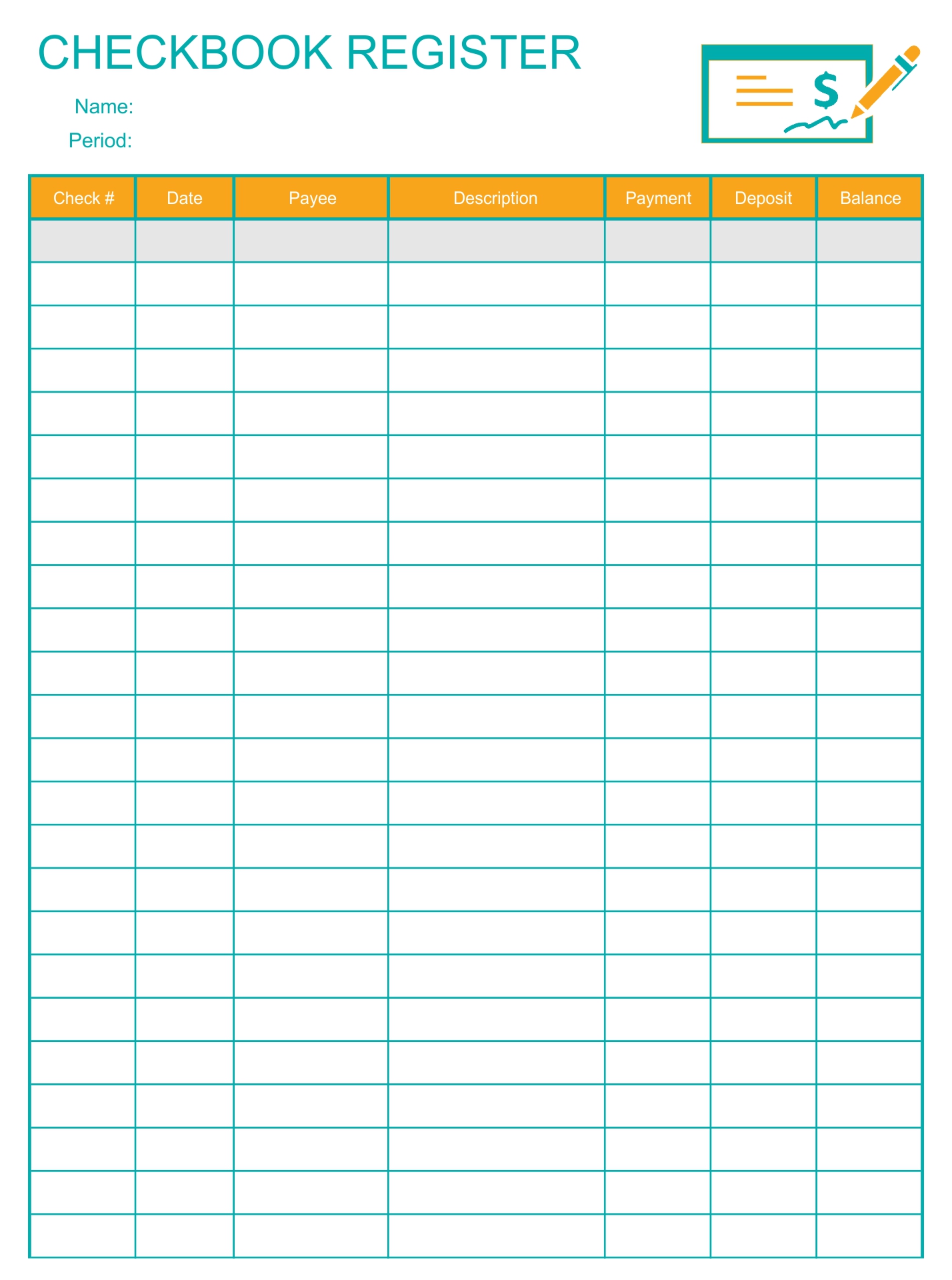

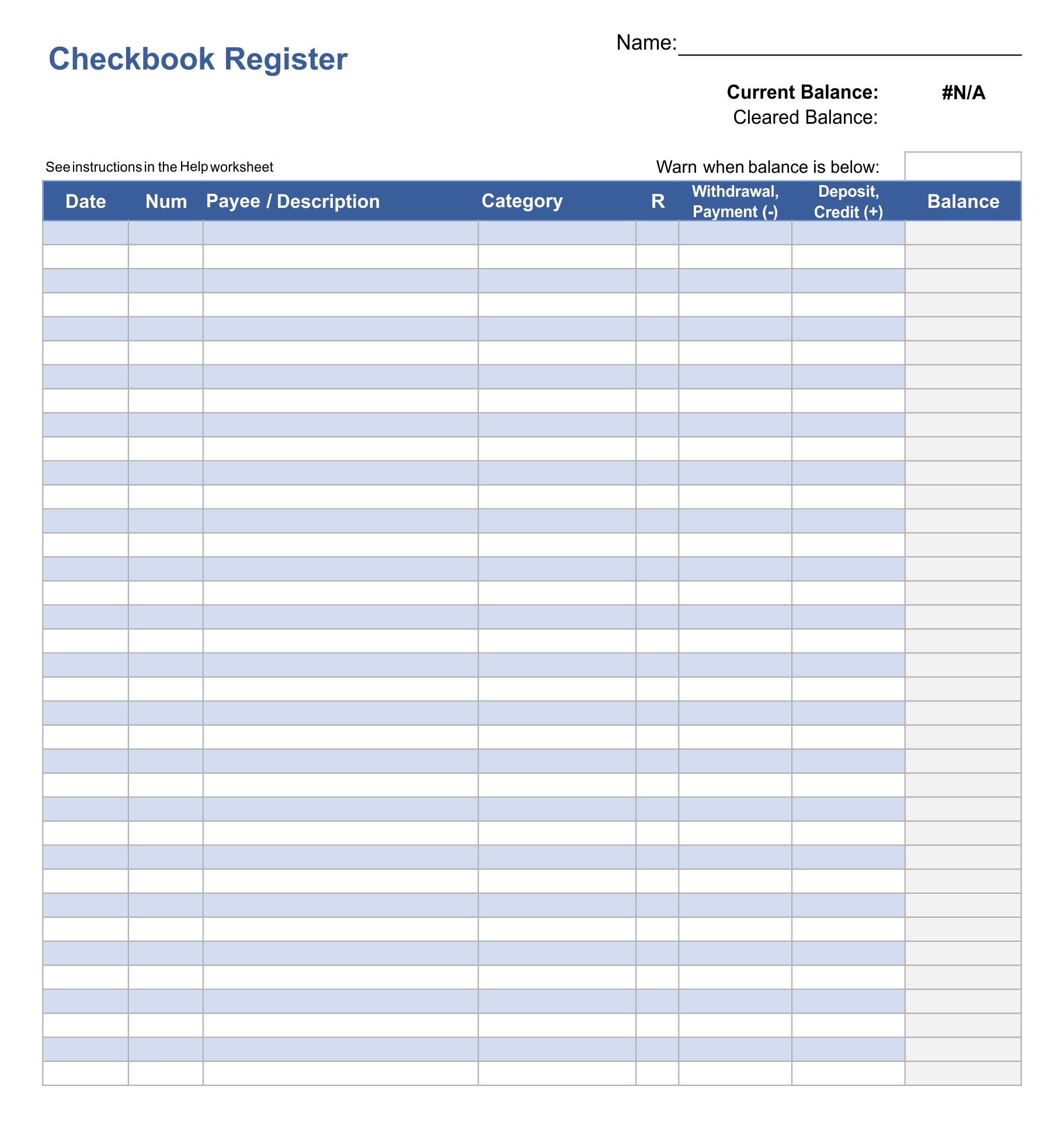

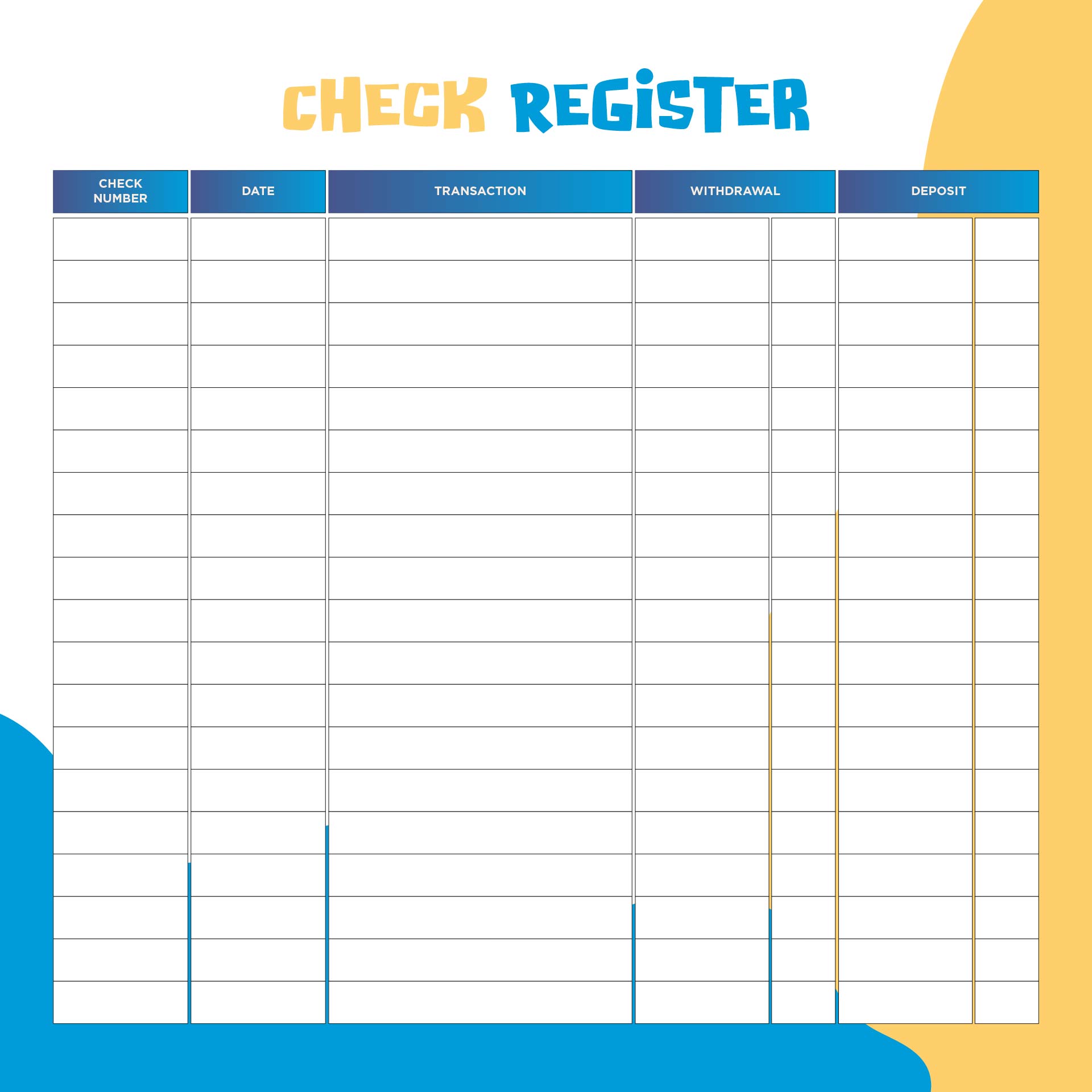

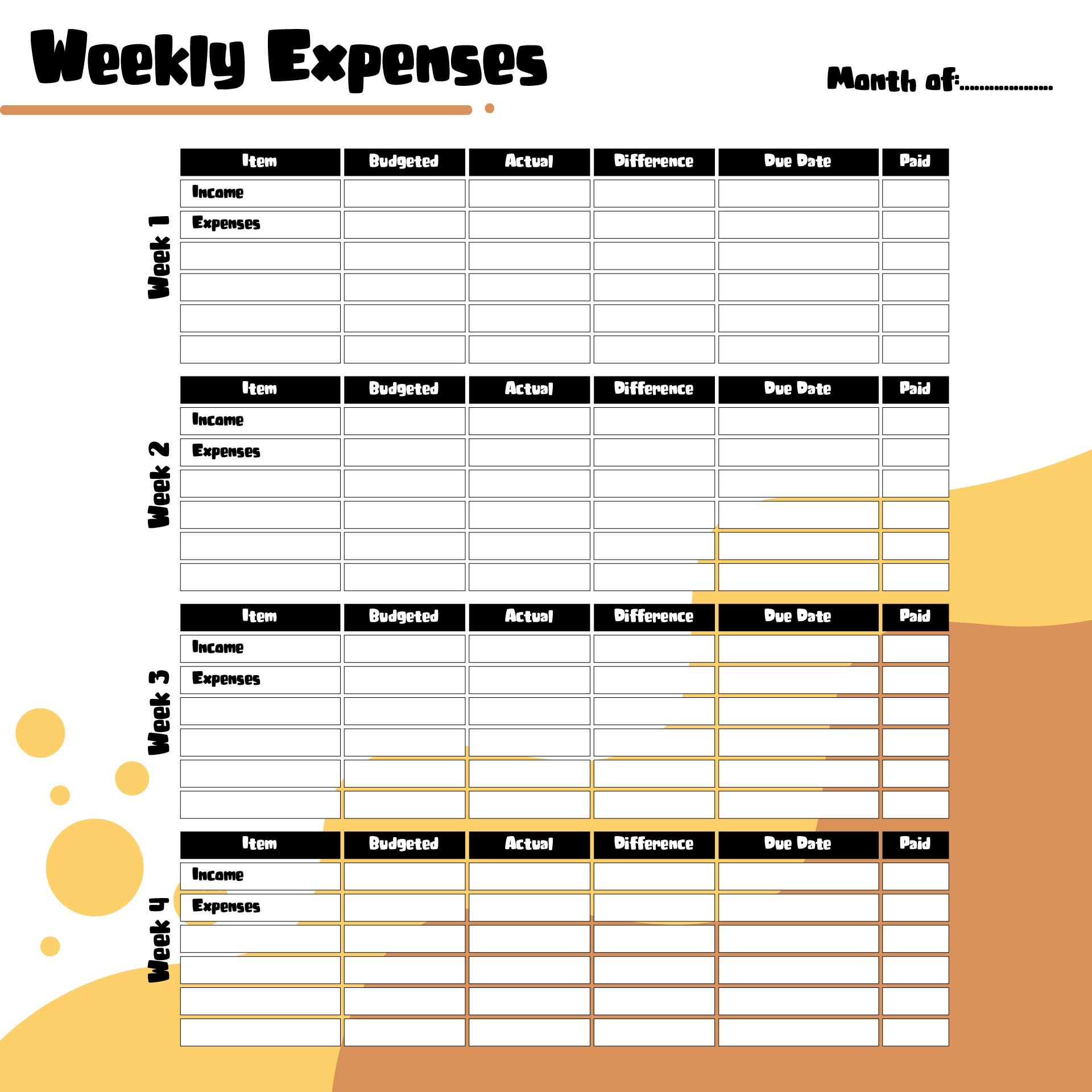

We design a printable checkbook register for easy tracking of income and expenses. This tool helps in keeping a clear record, preventing overspending. Handy columns for date, transaction description, debit, credit, and balance make it user-friendly. Managing finances becomes more straightforward with this practical solution.

The ease of use and potency of a checkbook register as a money management tool are frequently disregarded by small company owners. This small ledger can be a very useful tool for financial navigation, even beyond the obvious use of recording income and expenses.

Through transaction recording, entrepreneurs can obtain a comprehensive understanding of their cash flow, recognize trends in expenditure, and proactively oversee their spending plan. It can also be a tactical advantage for tax planning, aiding in the classification of deductions and guaranteeing adherence.

In a world of perpetual financial flux, small business owners can make well-informed decisions, grab opportunities, and maintain fiscal stability by utilizing this understated but powerful financial ally.

A checkbook register provides a straightforward and orderly way to keep track of and manage your financial activities, making it an easy way to keep tabs on your expenditures. It is contingent upon how you configure and manage it. Organization and consistency are crucial.

Set up distinct columns in the register for income and expenses. This facilitates the process of identifying money coming in and money going out. Don't forget to include a running balance column.

After every transaction, you can view your current account balance thanks to this. After every entry, update it. Establish financial objectives and monitor your progress using the data from your register.

This may encourage you to follow your budget. Don't merely log transactions and then disregard them. Check your register frequently to see where your money is going, and make any necessary adjustments.

A checkbook register for simplified banking is similar to having your financial GPS at your fingertips. It's a useful strategy that helps small business owners manage their finances without getting bogged down in the intricate world of online transactions.

You can easily track your inflows and outflows with this reliable ledger, providing you with a clear picture of your financial situation. It serves as your financial compass, guiding you in creating sensible budgets, preventing expensive overdrafts, and being ready for tax season.

Like a financial sidekick, the checkbook register is always there to help you make wise financial decisions and steer your business in the right direction.

Have something to tell us?

Recent Comments

Thanks for providing this free Printable Checkbook Register. It's a handy tool that helps me stay organized and keep track of my finances efficiently. Appreciate the convenience!

This free printable checkbook register is a simple and useful tool to help track my expenses and manage my finances efficiently. Thank you for providing such a helpful resource!

Thank you for providing this free printable checkbook register! It's a wonderful resource that helps me stay organized and mindful of my finances. Keep up the great work!